Advanced Digital

Retail Lending

Platform

Empowers Banks and Financial Institutions to Launch and Scale Retail Lending Products Faster, Safer, and Smarter

Solution Highlights

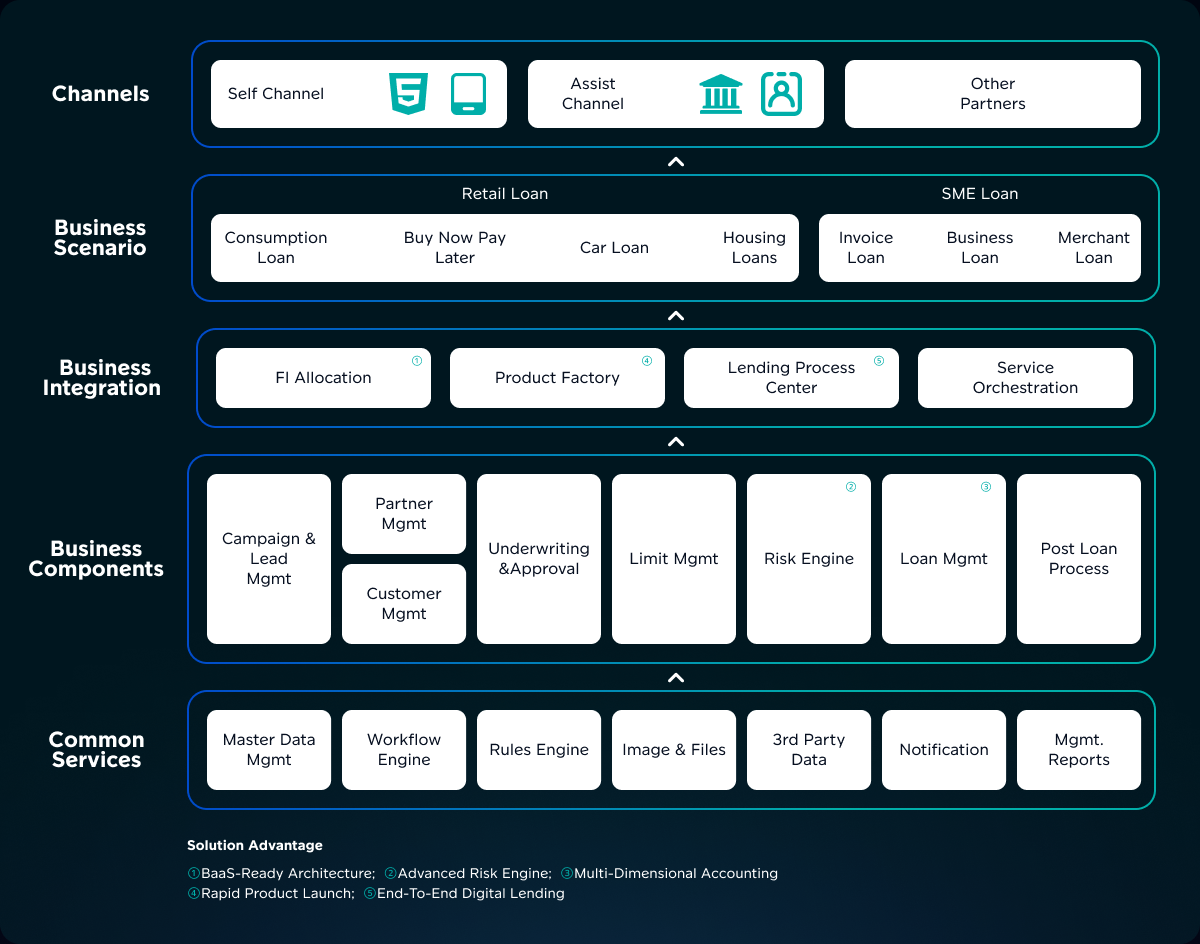

BaaS-Ready Architecture

Connect with partner banks via BaaS and optimize liquidity flows

Advanced Risk Engine

AI-driven risk engine for instant credit decisions and fraud control

Multi-Dimensional &

Granular Accounting

Granular accounting for accurate reconciliation & flexible reporting

Rapid Product Launch

Launch products fast with customizable flows & template-based setup

End-to-End Digital Lending

End-to-end digital lending with automated or hybrid workflows

Architecture

Life-Cycle Management

Product Design & Launch

· Multi-product configuration (personal, SME, co-lending)

· Customer-centric modeling (credit tags, qualification)

Loan Origination & Risk Control

· Real-time KYC/AML, biometric verification, OCR

· Anti-fraud checks, blacklist screening, risk scoring

Disbursement & Repayment

· 24/7 disbursement via core banking/payment APIs

· Configurable repayment plans (interest, penalty, partial)

Post-Loan & Exit Management

· Overdue classification, early warning, AI collection

· Settlement, write-off, litigation handling

Competitive Edge vs. Alternatives

BaaS-Ready

Architecture

Risk Control

Accounting

Accuracy

Rapid Product

Launch

Workflow

Flexibility

KTECH Retail

Lending Solution

Seamless partner integration with multi-tenant architecture

Automated decisioning,

real-time fraud detection

Multi-dimensional sub-ledger for precise reconciliation and compliance reporting

Template-driven configuration for rapid multi-product rollout

Fully configurable end-to-end digital lending (online, offline, hybrid)

Other Loan

Platform

Limited partner

support

Basic scoring,

limited fraud tools

Basic ledger,

limited granularity

Limited customization, rigid workflows

Limited flexibility, generic flows

Use Cases

Personal

Consumption Loan

Offer quick, flexible personal loans for everyday needs with seamless digital onboarding and instant approval for a smooth experience

SME

Business Loan

Empower SMEs with tailored financing solutions, fast approvals, and transparent terms to support growth and operational stability

Co-Lending with Leading Platforms

Partner with top platforms for co-lending, combining resources to expand reach, share risk, and deliver competitive credit offerings

Why KTECH?

Proven in Competitive Markets

Risk models and workflows tested in high-volume environments

Faster Time-to-Market

Launch new products in weeks with our template-driven product factory

Lower Operational Costs

Automation reduces manual processing by up to 70%

Future-Ready

Built for open banking and embedded finance ecosystems

Please fill in your information

-

Designated pre-sale consultant

-

Professional solution design

-

Free business consulting

Request a Demo

Seeing is believing! Schedule a live demo with one of our product specialists at your convenience. We can learn your requirements and help your team understand our system more efficiently.