November 3-7, 2025 – The Hong Kong FinTech Week & StartmeupHK Festival were grandly held at the Hong Kong Convention and Exhibition Centre. Marking the tenth anniversary of FinTech Week, the event established an international platform deeply integrating technological innovation and business value, bringing together over 37,000 senior executives, 800+ industry experts, and 700+ exhibiting institutions from more than 100 economies worldwide. As one of Asia's most influential fintech summits, this year's event focused on cutting-edge fields including artificial intelligence, Web3, blockchain, digital payments, and digital banking, continuously expanding its global perspective to build open collaborative bridges for participants and jointly compose a new chapter in Asian fintech development.

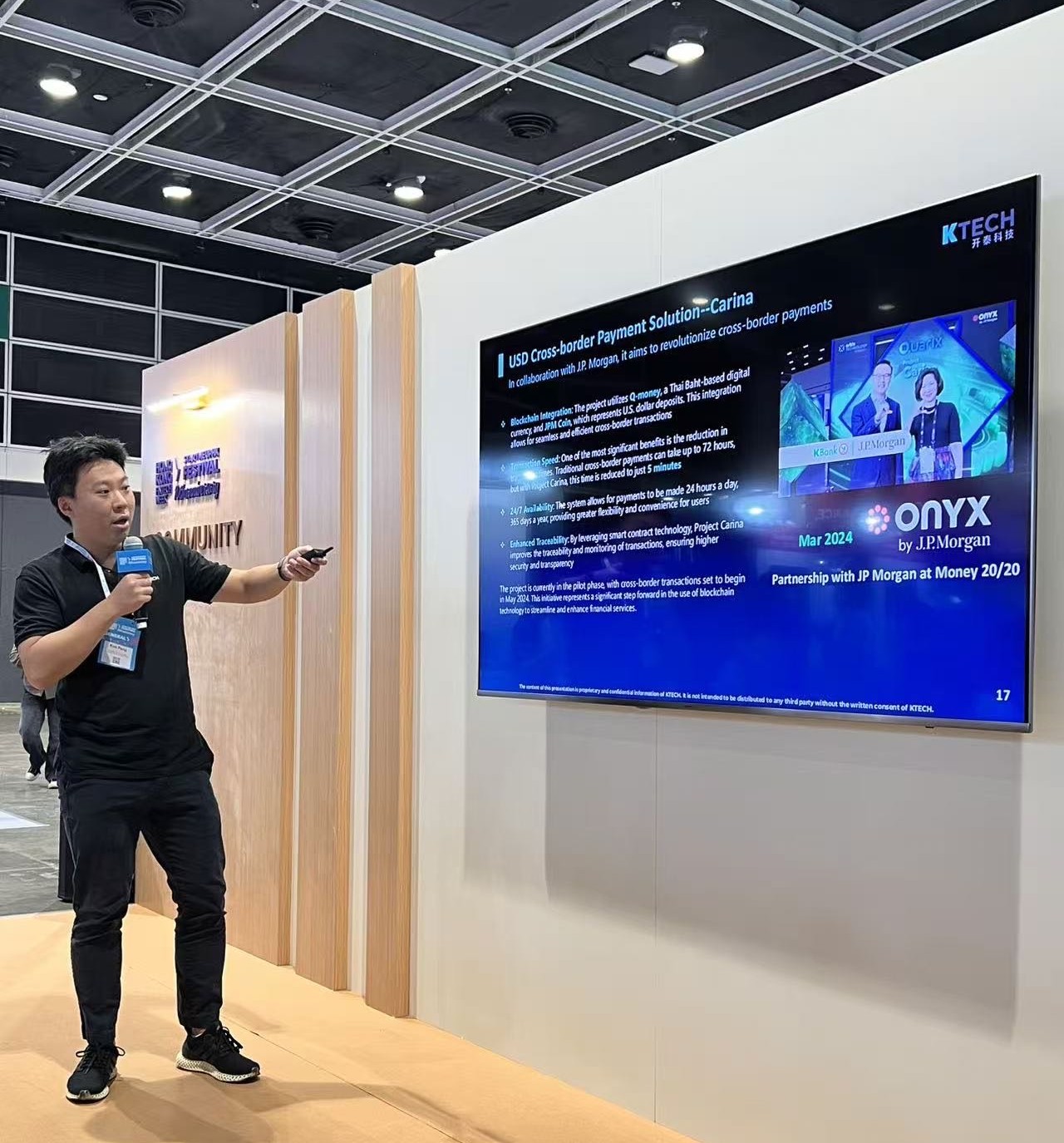

During the summit, the Hong Kong Monetary Authority unveiled the "Fintech 2030" vision, advancing industry upgrade through forward-looking planning. The vision concentrates on four key areas encompassing over 40 specific initiatives, summarized as the "DART" framework: Data & Payment – constructing next-generation data and payment infrastructure; AI – supporting comprehensive artificial intelligence adoption across the industry; Resilience – strengthening business and technological resilience; Tokenisation – promoting asset tokenization development. On this significant platform, KTech engaged in in-depth exchanges with global fintech leaders, conducting professional dialogues around digital assets and tokenization technologies under the "DART" strategic framework.

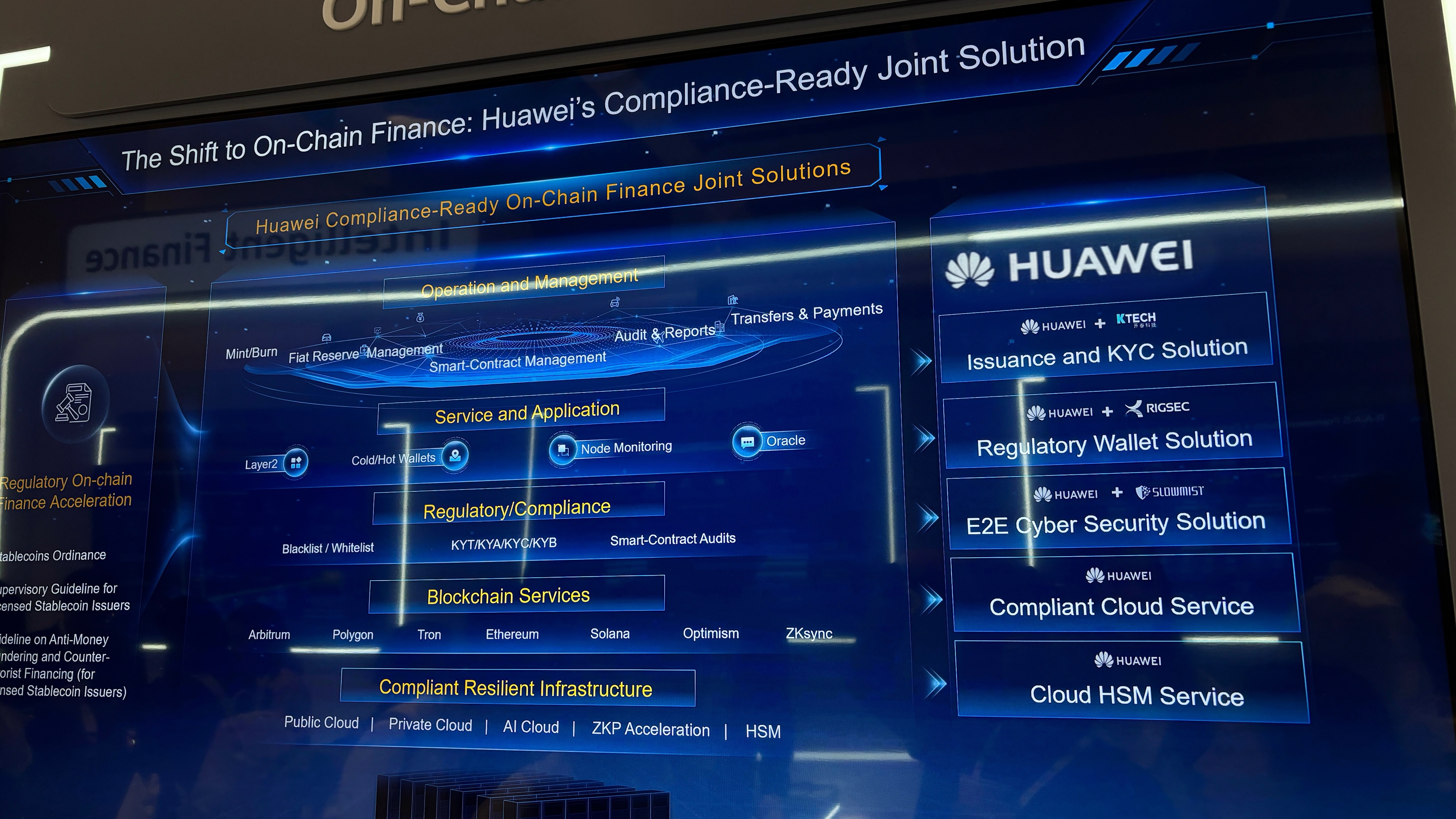

As an advanced solution provider deeply rooted in the fintech sector, KTech consistently upholds innovation and technological excellence, continuously driving regional business expansion for KBank Group and digital transformation for clients, and KTech is Huawei's leading software partner for its On-Chain finance business line, delivering comprehensive, full-stack blockchain solutions that drive innovation and strengthen Huawei’s financial technology ecosystem. Building on this solid foundation, the company now extends its mature technical capabilities to broader enterprise-level solutions, covering Retail Lending Platforms, Supply Chain Finance, Cross Border Payment, Digital Asset Custody, Stablecoins, and Regulated Public Blockchain among other banking, blockchain, and Web3 innovations.

Secure and Compliant Next-Level Digital Asset Custody Platform

KTech's bank-grade digital asset custody solution establishes robust protection for client assets through industry-leading security protocols. The solution's core advantage lies in its innovative next-level custody engine, which leverage advanced key management with cold wallet to comprehensively support scalable secure custody of diverse digital assets including Bitcoin, Ethereum, stablecoins, and NFTs.

In addressing institutional customization needs, the platform offers comprehensive white-label power, supporting customize portals and controls to reflect various institutions’ brand identity. Simultaneously, the system's built-in automated compliance processes cover critical areas including AML/KYC and transaction screening, ensuring full compliance with global regulatory standards. Through real-time compliance reporting and third-party audit mechanisms, it achieves transparent and verifiable end-to-end operations.

Based on scalable system architecture and streamlined operational processes, the solution applies to multiple crucial scenarios: enabling traditional banks to expand digital asset services while providing highly secure cold storage solutions for trading platforms; supporting government treasury departments in managing national digital assets and central bank digital currencies while offering reliable custody and governance frameworks for tokenized real-world assets. This comprehensive service capability is empowering global institutions to securely and compliantly enter the new era of digital assets.

Turnkey, Compliance-Ready Stablecoin Platform

KTech has launched an end-to-end, compliance-ready stablecoin platform, providing complete solutions for enterprise-level applications. The platform features five core highlights: first, a compliance infrastructure with built-in KYC/AML, governance modules, and real-time reporting aligned with global regulatory frameworks (e.g., MiCA, FATF); second, bank-grade security utilizing third-party audited code, FIPS 140-2 Level 4 Hardware Security Modules (HSM), and dual-key privacy architecture; third, end-to-end lifecycle management enabling full control from issuance to redemption; fourth, high throughput and scalability, processing 10,000+ TPS based on Layer-2 infrastructure with auto-scaling capability; fifth, cloud-native agility supporting modular deployment on major cloud platforms with out-of-the-box CI/CD pipelines.

The platform establishes a four-phase lifecycle management system: supporting dynamic collateral pools and smart contract automated deployment during the design and issuance phase; achieving real-time devaluation alerts and compliance execution during the operations and risk mitigation phase; providing instant user redemption and supply adjustment during the redemption and burn phase; executing regulator-guided closure protocols and fund repatriation during the decommissioning phase.

The solution applies to multiple scenarios: cross-border remittances can reduce costs by 80% for emerging markets; institutional treasury management hedges cryptocurrency volatility through algorithmic rebalancing; supply chain payments achieve B2B settlement automation via smart contracts; government disbursements ensure transparency in public sector payments.

Regarding compliance and security, the platform adapts to multiple jurisdictional requirements, employs zero-knowledge proofs to ensure transaction privacy while maintaining regulatory audit functionality, and guarantees 100% collateralization through real-time attestation, providing reliable assurance for stablecoin circulation.

Through its impressive presence at Hong Kong FinTech Week, KTECH has not only comprehensively demonstrated its technical capabilities in digital asset custody and stablecoins but also highlighted its firm commitment to promoting fintech innovation and regional digital economic development. Looking ahead, KTech will continue to deepen technology R&D, expand cross-border financial cooperation, and leverage secure, compliant, and innovative technology solutions to help global financial institutions and enterprises seize new digital finance opportunities.